UK Money to Australia

Bringing your funds from the UK to Australia.

Try to avoid bringing more than $10,000 in Hard Cash into the country, Customs may confiscate it if you try to hide it from them, and even when you do declare it, it could cost you a few hours explaining it all.

Note that currency means physical money.. so $6,000 in bank notes and $6,000 in travellers cheques, although $12,000 in total, is still only classed as $6,000 in currency to the Customs officials. Source: Click here for link

There are a number of options for sending your funds electronically, and these include:

- Any of the main Banks.

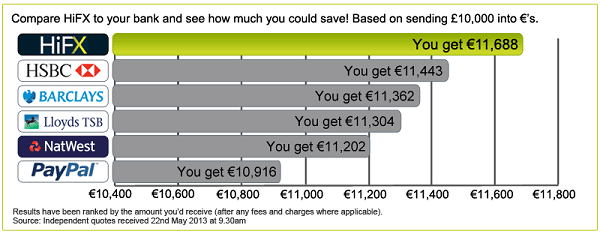

- HIFX – HIFX is the UK’s premier provider of corporate foreign exchange

- Currency Solutions.co.uk –

- Tranzfers.com – International Money Exchange, owned by Ozforex Pty Ltd in Australia.

- Ofx.com

- Moneycorp.com

- Interchangefx.co.uk

- Travelex.co.uk

Will you be taxed on the money you bring?

This is a common question, and the general answer is NO, unless you don’t bring the money with you at the time that you migrate. Even then, the only tax you will pay, will be on any increase in its value since you became resident here. This change in value can be just from the Exchange rate movements, or the interest you have gained from Bank Accounts in the UK, or even property value increases.

An example to try to explain this:

Assume you have a property in the UK valued at 100k, and 20k in the bank.

You move over when the exchange rate is say 2.4 to the A$, therefore you are worth $288,000.

Assume you bring your funds over 3 months later and the exchange rate at the time is 2.45 to the A$.

You bring 120k x 2.45 = $294,000.

Your worth has increased by $294k – $288k = $6,000 and this is the figure that is taxable as part of your income for the relevant tax year. If the value of the house had gone up or down it would affect the taxable figure accordingly.

Premium Bonds in the UK

Although a win on the Premium Bonds in the UK is NOT taxable, it will be taxed if you are Australian Tax Resident. This is based on the Australian Rule that gambling is non taxable, but investments are taxable, and Premium Bonds are classed as an investment. (ie: They are provided by the UK National Savings & Investments.)

The actual ATO quote is:

An investment-related lottery is one where the chance to win a prize arises because you hold an investment with an investment body such as a:

- bank

- building society, or

- credit union.

The value of benefits or prizes you receive from an investment body you have invested in must be included as assessable income on your tax return.

Using UK cards to access UK money in Australia

For some time many people have used a Nationwide account card to access funds in Australia without paying a fee.

This appeared to change from 6th May 2009 on credit cards and 1st June 2009 on debit cards.

This fee looks like it will be about 1%. More details at: