Category: Retirement

132

Australian Aged Pension Eligibility – Income

Income Requirement to be eligible for the Australian Aged Pension.

Services Australia (Centrelink) have income limit requirements, for someone to be eligible for the Australian Aged pension. It is called the “Income test for pensions“. Centrelink assess your and your… Read the restAustralian Aged Pension Eligibility – Residence

Residence Requirement to be eligible for the Australian Aged Pension.

Services Australia (Centrelink) state the following rules for the Residency Requirement, to be eligible for the Australian Aged pension. To get Age Pension you generally need to have been an… Read the restAustralian Aged Pension Rates March 2021

The Australian Aged Pension from March 2021.

The Australian Aged Pension is revised in March and September (normally) each year, and the March 2021 new Pension Rates have been released. This pension is paid Fortnightly. The Age Pension recipients will… Read the restAustralian Aged Pension Rates 2020

Australian Aged Pension Rates March 2020.

An Australian Citizen or Permanent Resident may be eligible for the Welfare Based Aged Pension if they are an Australian resident, and have been for at least 10 years; and are at least 66… Read the restAustralian Aged Pension Rates 2019

Australian Aged Pension Rates September 2019

An Australian Citizen or Permanent Resident may be eligible for the Welfare Based Aged Pension if: They are at least 65 years and 6 months old (New rules from 1st July 2017) under the… Read the restAustralian Income Tax on UK Age Pension

Income Tax on a UK Age Pension received in Australia

When you retire in Australia, and also receive a UK pension, this pension will be included in your taxable income, and taxed at normal rates, based on the tax band… Read the restAge Pension: Will a UK Pension affect my Australian Centrelink payment

Will a UK Pension affect my Australian Centrelink payment?

When you compare a UK Pension and Australian Centrelink, the short answer is that it might affect a Centrelink payment. Foreign pensions received by a person paid an autonomous age pension,… Read the restAustralian Aged Pension Rates 2017

Australian Aged Pension Rates 2017

An Australian Citizen or Permanent Resident may be eligible for the Welfare Based Aged Pension if: They are at least 65 years and 6 months old (New rules from 1st July 2017) under the income… Read the restAustralian Aged Pension Rates 2017

An Australian Citizen or Permanent Resident may be eligible for the Welfare Based Aged Pension if: They are at least 65 years and 6 months old (New rules from 1st July 2017) under the income… Read the restUK Aged Pension: 60% Part Pension for Spouse

Can you get an extra 60% British Aged Pension for your Wife

In the Australian News today. 28th July 2017, is an article saying: “there’s a little-known opportunity to get a 60 per cent part pension for your spouse too… Read the rest25% Tax Penalty on Some QROPS Pension Transfers

HMRC Introduces 25% Tax Charge On Some QROPS Transfers

Written by Anthony Blythe of Transfer My UK Pension The Chancellor of the Exchequer used his Spring Budget to announce that, with effect from 9th March 2017, pension transfers by UK… Read the restTransfer British Pension to Australia

Getting Your British Pension in Australia

Transfer British Pension to Australia, when you migrate to Australia from the United Kingdom, can involve more than one pension fund in the UK, and consideration must be given to what to do with… Read the restAustralian Aged Pension Rates 2016

Australian Aged Pension Rates 2016

The Australian Aged Pension was increased in March 2016, and the new FORTNIGHTLY rates are now: Australian SINGLE PERSON Pension $794.80 Base Pension $ 65.00 Supplement $ 14.10 Clean Energy Supplement $873.90 Total COUPLE (each)… Read the restAustralian Aged Pension Rates 2016

The Australian Aged Pension was increased in March 2016, and the new FORTNIGHTLY rates are now: Australian SINGLE PERSON Pension $794.80 Base Pension $ 65.00 Supplement $ 14.10 Clean Energy Supplement $873.90 Total COUPLE (each)… Read the restBritish Expat Pensioners in Australia returning to UK

Rise in British Expat Pensioners in Australia returning to UK

A news story about British Expat pensioners in Australia having to return home to the UK because they can’t afford health care is in a Telegraph news article. The article… Read the restUK Chancellor cuts Pension benefits for Brits abroad

Anyone who is out of Britain for more than a month will lose their pension credit.

Anyone who leaves Britain for more than a month will lose their pension credit, in a blow for retirees who spent time overseas The… Read the restRetirement Pension

Retirement Pension Income in Australia

The Australian Retirement pension consists of two possible parts: The Government Aged Pension Benefit, paid by Centrelink (the welfare system). The compulsory Employer Paid Super scheme. The British Retirement pension consists of two possible parts:… Read the restAustralian Superannuation Co-contribution scheme

Australian Superannuation Co-contribution scheme

The super co-contribution scheme is designed to assist eligible individuals to save for their retirement. If you are eligible and make personal super contributions during a financial year, the government will match your contribution with a… Read the restAustralian Compulsory Superannuation Rates from 2014

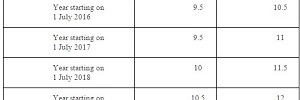

Australian Compulsory Superannuation Rates from 2014

The minimum Superannuation contribution from your Employer rose to 9.50% from July 2014. The majority of Workers in Australia, have had individual Superannuation schemes since 1992 when the Compulsory Superannuation Scheme was first set… Read the restAustralian Compulsory Superannuation Rates from 2014

The minimum Superannuation contribution from your Employer rose to 9.50% from July 2014. The majority of Workers in Australia, have had individual Superannuation schemes since 1992 when the Compulsory Superannuation Scheme was first set… Read the restClaiming Australian Superannuation back when leaving Australia

When leaving Australia for good, you may wish to claim as much of any Australian Super as you can.

This can be reclaimed in some circumstances before you reach retirement age.

australia.gov.au/service/superannuation-departing-australia

If you are a former temporary resident, you… Read the rest

Tax when Retiring in Australia

When a Brit retires in Australia, as a resident, and has a UK pension, either State or Private, this will be taxed in Australia. (The same as any other income).

To ensure that this income is NOT taxed in BOTH… Read the rest